JULO Celebrates The 6th Anniversary: Begins 2023 with Tokens of Appreciation to Indonesian Digital Credit Users

Indonesian digital credit service provider, PT. JULO Teknologi Finansial (JULO) has supported financial inclusion to million of Indonesian with accessible digital credit service. As the fintech lending platform which received a full license from Indonesia’s Financial Services Authority (OJK), JULO has recorded the transaction amount increase by more than three times during 2022 and business income growth by 100% to the year prior. Since its establishment by 2016, JULO has disbursed more than 6 Trillion IDR throughout the nation.

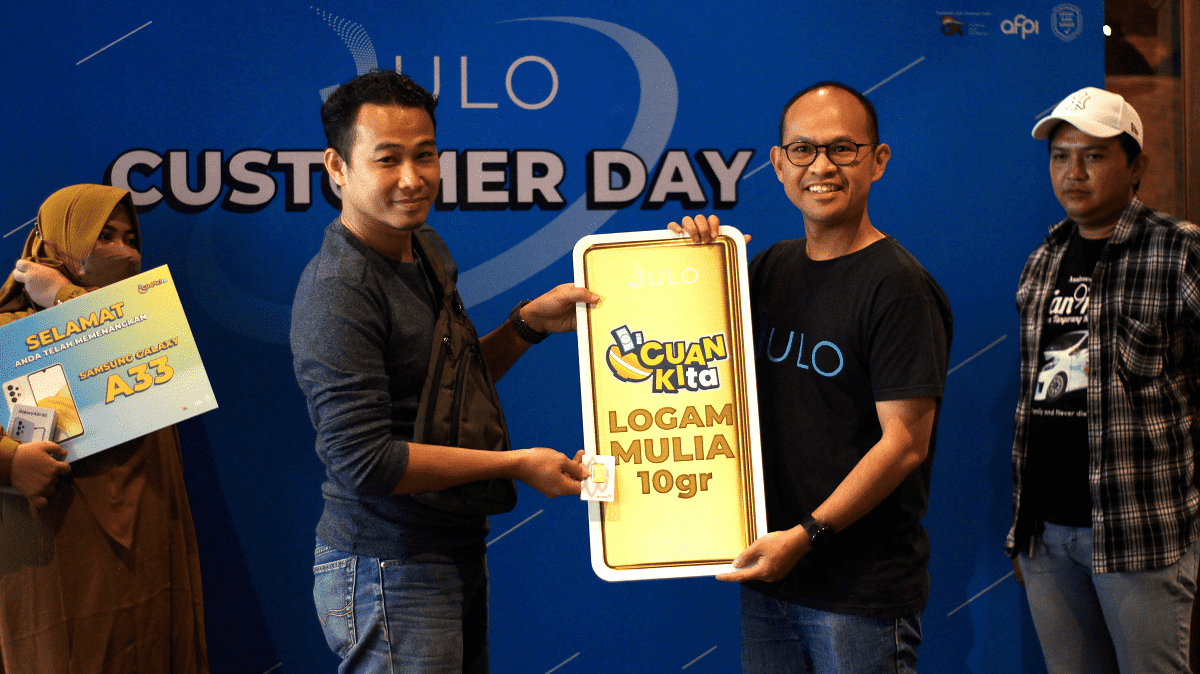

Through the vision to provide financial empowerment, JULO begins 2023 with tokens of appreciation to Indonesian digital credit users by hosting JULO Customer Day event. As the tribute to active JULO users with proficient record, JULO has distributed various grand prizes - from motorcycle, gold bars and millions of cash - and credit limit increase. Invited JULO user, Maria Christina stated, “I’ve been using JULO for 5 years and felt really appreciated through JULO Customer Day event. Thanks to JULO features, it’s been much easier for me to support and organize my family's financial needs - with all of the credit limit!”

Read More: CERITA MELESAT: Pakai JULO untuk Modal Buka Usaha!

Bringing further empowerment in financial literacy, JULO also collaborates with Finplan.id, renowned financial community platform during JULO Customer Day seminar session. Titled ‘Ngobrol Cuan Bareng JULO’ (Money Talk with JULO), Alif F Adzani - Finplan.id co-founder - shared daily tips in utilizing financial instruments to be empowered better in the future. “It really excites us to work together with JULO, in creating better financial literacy for Indonesia. Aligned with our vision as a financial community platform, JULO has taken such bold steps in improving literacy and creating better financial empowerment as the output.” stated Alif F Adzani.

Hans Sebastian, Co-founder and Head of Engineering JULO stated, “As the beginning milestone of 2023, JULO committed to bring further empowerment with greater appreciation and education to digital credit users. We hope as JULOvers will be able to elevate their life further with all of the prizes and things learned from JULO Customer Day. Supported by continuous innovation in product, JULO always invent new promotion programs that benefit users most and creating better financial inclusion as the result. Just like how we went with the recent Kado Dekor Impian program, where every JULO user can win free room makeover amounts 30 millions IDR in total.”

Read More: JULO Menyalurkan Lebih Dari 70% Dana Untuk Pinjaman Produktif Nasabah

Digital credit access by JULO aims to empower and elevate users' lives financially. Tri Setiawan, as one of the JULO users stated, “As an online driver, JULO really helps me during tough times. With the approval, I could pay my utilities bills and the rest goes to my side groceries selling business. Thankfully, my business grows and I could upgrade my motorcycle - improving my daily income as an online driver”. Donny Patrick also felt really grateful as JULO user. “With JULO around, I can improve my financial stability to its fullest. It’s been easier for me to fulfill all of the daily and business needs with JULO complete features. Especially with all of the beneficial promos around!”

CEO & Co-founder JULO, Adrianus Hitijahubessy stated, “JULO will never make it big without such tremendous supports and trusts from Indonesia - especially JULO users. Salute to more than one million JULO users, for trusting JULO in elevating their welfare and improving the overall financial inclusion. With such precious six years momentum, JULO strives to grow relentlessly in the upcoming years through continuous features and technology innovation - resulting in better financial empowerment through accessible digital credit service.”

Supporting such continuous innovation in products and promotions, JULO also implemented strategic partnership in every level to create accessible digital credit service within the underbanked. From eFishery to GrabModal program, JULO aims to strengthen the empowerment among Indonesian by fulfilling the daily and business needs financially with credit limit on-hand.

Accessible within the 37 provinces of Indonesia, 70% of JULO credit has been used for life improvement purposes such as business capital, home renovation and education. In the mid of 2022, JULO has been supercharged with series-B funding from Credit Saison in total of US$80M. JULO also aspires to create more strategic partnerships in the future and enables more people to be empowered financially.

#SiapMelesat Cashless with JULO!

Fun fact: There are millions of people getting financially empowered by JULO features!